Emergency Funds: Why They Matter and How to Build One from Scratch

Financial stability doesn’t come from high income alone, it comes from preparation. One medical bill, one car breakdown, or one missed paycheck can undo years of progress if you don’t have a safety net. That safety net is your emergency fund.

Too often, people without savings turn to short-term lenders in a crisis. Reviews of payday providers like Check n Go show how quickly a small loan can spiral into a cycle of interest and fees. The better alternative is building even a modest emergency fund that keeps you from needing high-cost credit in the first place.

This article explores why emergency funds matter, how much you should save, and step-by-step strategies for building one, even if your budget feels impossibly tight.

What Exactly Is an Emergency Fund?

An emergency fund is money set aside specifically for unexpected expenses. Unlike general savings, it’s not for vacations or gadgets. It’s for life’s surprises:

- Medical emergencies.

- Car or home repairs.

- Job loss or reduced hours.

- Family crises.

The fund provides peace of mind and keeps you from falling back on credit cards or loans when life doesn’t go according to plan.

Why Emergency Funds Are Essential

- Break the debt cycle: Without savings, every crisis pushes you into debt, creating interest that drains your income.

- Reduce stress: Knowing you have a cushion makes financial setbacks less overwhelming.

- Increase flexibility: With savings, you can make better choices—like taking time to find a new job instead of grabbing the first offer.

- Protect long-term goals: Your retirement savings or education fund won’t be derailed if emergencies don’t touch them.

How Much Should You Save?

The classic rule is 3–6 months of living expenses. That can feel impossible when you’re just starting. Instead, think in stages:

- Stage 1: $500 — enough to cover small emergencies like car repairs.

- Stage 2: $1,000 — handles most common unexpected bills.

- Stage 3: One month of expenses.

- Stage 4: Three to six months of expenses for true financial security.

Start small. The important part is progress, not perfection.

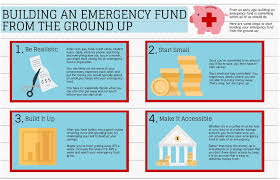

Step-by-Step Guide to Building an Emergency Fund

Step 1: Open a Separate Account

Keep your emergency fund away from your daily checking account so you’re not tempted to dip into it. A high-yield savings account works best.

Step 2: Automate Contributions

Set up automatic transfers after every paycheck. Even $25 per week builds momentum.

Step 3: Start with Small Wins

Sell unused items, cut subscriptions, or redirect bonuses and tax refunds into the fund. These lump sums jump-start your progress.

Step 4: Cut Expenses Strategically

Identify “low-hanging fruit” expenses. Cooking at home twice a week instead of dining out can free $100 a month for your fund.

Step 5: Increase Income

Freelance gigs, overtime, or side hustles can accelerate savings. Dedicate this extra money exclusively to the emergency fund.

Step 6: Protect Your Fund

Once built, don’t touch it for non-emergencies. Create clear rules for what qualifies as an emergency.

Overcoming Common Challenges

- “I don’t earn enough to save.” Start with $5 a week. Progress matters more than size.

- “Emergencies keep draining it.” That’s the point—it’s doing its job. Refill it after each use.

- “I keep dipping into it for wants.” Separate accounts and strict rules solve this.

Emergency Funds vs. Credit Cards

Some people argue a credit card can serve as an emergency fund. While cards provide temporary relief, they also add interest and can damage your score if balances rise too high. An emergency fund is debt-free protection, not borrowed money.

Learning from Community Experiences

Many borrowers share online how they fell into debt because they lacked savings. Platforms with Loans reviews according to Reddit are full of stories where a small unexpected bill turned into years of repayments. Building an emergency fund avoids that trap and gives you control when life goes sideways.

Long-Term Benefits of an Emergency Fund

- Lowers reliance on high-interest debt.

- Improves credit score by preventing late payments.

- Provides peace of mind that supports mental health.

- Creates a foundation for future financial goals, like investing.

Conclusion: Your Safety Net Starts Today

An emergency fund isn’t about wealth, it’s about resilience. Even a few hundred dollars saved can prevent disaster. Start small, automate your savings, and treat the fund as sacred. Every deposit builds a stronger safety net and a stronger you.

When the next unexpected expense arrives, you’ll be ready, and instead of reaching for a loan, you’ll reach for your own savings. That’s financial freedom in its simplest form.