Overview of Rental Expenses

Are you a landlord aiming to boost profits and cut taxes? Dive into the world of rental expenses to master financial success. Learn to track and report costs efficiently, unlocking tax deductions and optimizing rental income.

Stay organized, plan ahead, and equip yourself with the tools needed for managing expenses.

Let’s explore the essential aspects of rental expenses to help you make informed decisions and run a thriving rental business.

Definition and Importance of Rental Expenses

When managing rental properties, you need to understand the definition and importance of rental expenses. Rental expenses encompass the various costs associated with running a for-profit rental business, such as utilities and maintenance. Keeping detailed records of these expenses is crucial as they can lead to significant tax deductions, ultimately reducing taxed rental income and boosting profits.

Operating expenses, which include day-to-day costs like advertising, property taxes, insurance, and utilities, must be ordinary, current, directly related to rental activity, and reasonable. By properly reporting these expenses, landlords can retain more money and maximize their deductions, resulting in a lower taxable rental income and increased financial gains.

Understanding rental property operating expenses is key to effectively managing your rental properties.

Types and Examples of Rental Expenses

To understand the breakdown of rental expenses, examine the types and examples of costs incurred in a for-profit rental business. Operating expenses are essential day-to-day costs for rental properties that must be ordinary, current, directly related to rental activity, and reasonable. Examples of operating expenses include advertising, property taxes, insurance, and utilities.

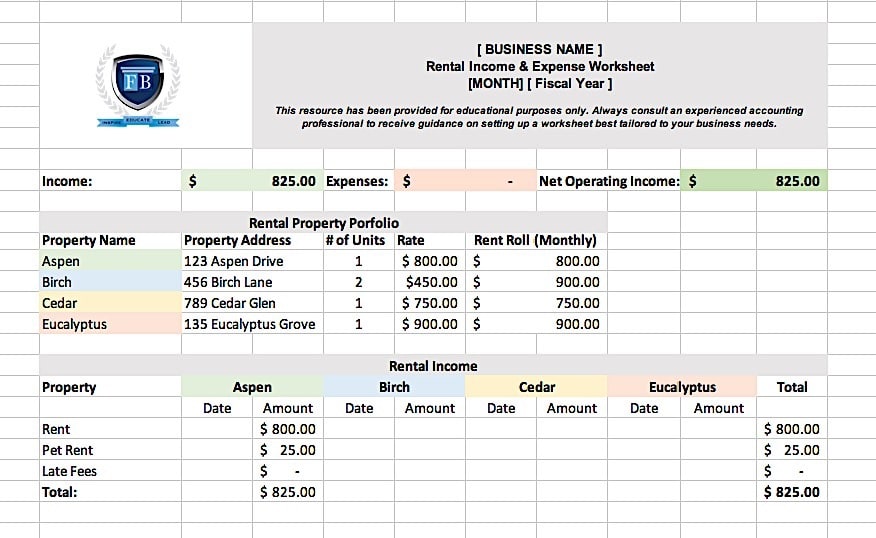

Most landlords qualify for pass-through tax deductions on operating expenses, categorized on the Schedule E form. Utilize tools like rental property expenses spreadsheets or accounting software for tracking income and expenses efficiently. Rental property accounting software provides cloud-based solutions for expense tracking, such as LedgRE with customizable options.

Staying organized and utilizing tools like spreadsheets and accounting software will help you effectively manage expenses in your rental business.

Reporting and Maximizing Rental Expenses

To accurately report and maximize your rental expenses, ensure meticulous documentation of all income and costs associated with your rental properties. Keeping detailed records allows you to claim all eligible deductions, reducing your taxable rental income and ultimately increasing your profit.

When filling out your Schedule E form for tax purposes, accuracy and thoroughness are key. By documenting every expense, from property taxes to maintenance and repairs, you can optimize your deductions and financial outcomes.

Remember that proper reporting not only ensures compliance with tax regulations but also helps you make informed financial decisions regarding your rental properties. Stay organized, track all expenses diligently, and reap the benefits of maximizing your rental expenses.

Tools for Managing Rental Expenses

Ensure meticulous documentation of all income and costs associated with your rental properties for effective management of rental expenses through the use of tools.

Utilize your rental property expenses spreadsheet or accounting software for tracking income and expenses. Opt for rental property accounting software, like LedgRE, offering customizable cloud-based solutions for expense tracking. These tools streamline expense management, providing clear insights into your financials.

By staying organized and leveraging these tools, you can efficiently monitor and control your rental expenses. Take advantage of technology to simplify the process, ensuring you maximize deductions and enhance profitability.

Stay proactive in managing your rental property finances to achieve financial stability and success as a landlord.

Financial Planning

Manage your rental property finances effectively by planning for both expected and unexpected expenses, ensuring financial stability and success as a landlord. Setting aside a portion of your rental income for a contingency fund can help you cover unforeseen costs like emergency repairs or sudden vacancies.

Creating a detailed budget that includes all regular expenses, such as mortgage payments, property taxes, insurance, and maintenance, will provide a clear overview of your financial obligations. Additionally, consider consulting with a financial advisor to develop a comprehensive financial plan tailored to your rental property business.

Conclusion

Now that you have a better understanding of rental expenses, you can effectively manage your costs, maximize tax deductions, and optimize your rental income.

By staying organized, utilizing tools for expense tracking, and planning ahead, you can ensure the financial success of your rental business.

Remember to stay informed and proactive in managing your expenses to make informed decisions and run a successful rental business.